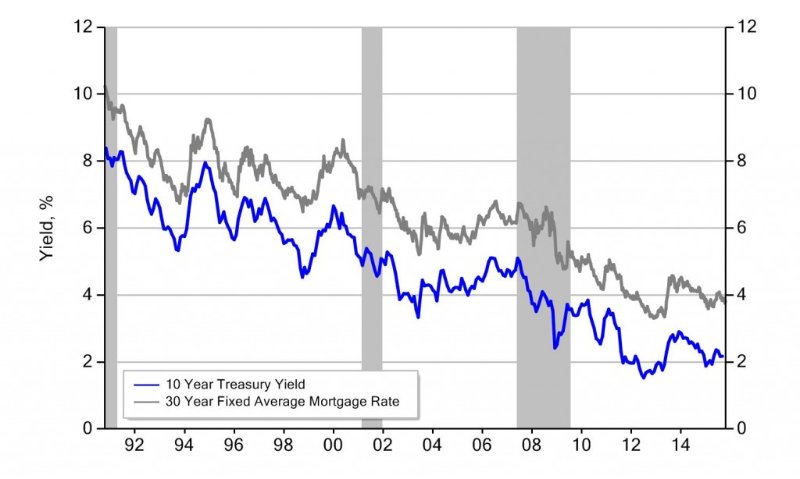

Still here? Whewwwwf, thought I might lose a few you. Today’s post covers how to predict short-term rate movements in the mortgage market. Let’s start with one simple fact – Correlated to the yield on long-term treasury notes, mortgage rates are highly positive.

IMPORTANT: You do not need to know what correlation, yield, or a treasury note is for this to be helpful. Check out this article if you want to learn a bit more about those nasty sounding words.

Just as lightning always precedes thunder, movements in the treasury market always precede movements in the mortgage market. To predict where mortgage rates are headed in the very short-term, all you have to do is follow the stock ticker symbol TNX – the 10 year treasury note. As TNX increases, mortgage rates will quickly follow and vise-versa. To further clarify, increases in the TNX lead to higher short-term mortgage rates (positive correlation for you stat nerds).

The reason I emphasize short-term is because lenders are quick to adjust to changes in the treasury markets. They are typically able to push out new pricing within a few hours. Below are two examples about how you can use the TNX to outwit your non-psychic peers!

- If you see significant increases in the TNX, you should immediately get in touch with your lender and lock your current rate before the lender increases pricing.

- If there are significant decreases in the TNX, you should NOT lock your rate (this is called “floating”) as there will likely be a reduction in pricing in the near future.

It’s important to note that typically you will need to be under contract on a property to be able to “lock” your rate so this new skill you have acquired is primarily useful at that time. My next post will get into the details of “locking” vs “floating” your mortgage rate…

Congratulations. Your psychic skills now rival those of the famous Miss Cleo!

YouTube

Real Estate Jargon Key

correlation– the degree to which two or more variables show a tendency to vary together

yield– in simplest terms, yield is nothing more than an annualized percent of interest based on a principal amount invested. To a lender, the yield on a mortgage is the annual rate of interest that you pay

treasury note– essentially an IOU from the government that pays a stated rate of interest until the note is due- these are considered “risk-free” investments, as the likeliness of getting paid back is as close to 100% as you’ll get in an investment (unless you’re Greece or many other insolvent nations)

ABOUT THE AUTHOR. Greg Robertson is the Managing Broker of Class Realty Group, a full-service real estate brokerage based in Solana Beach, California. He earned an MBA & Finance Degree from San Diego State University and has extensive professional experience in both residential and commercial real estate.